︎︎︎episode 68

The Underwear Oracle, Lipstick Effect and Fro Za Indicator + more weird but true Recession Trends!

Jan 9th, 2023

︎︎︎︎ Listen on Apple

︎︎︎︎ Listen of Spotify

︎︎︎︎ Listen on Stitcher

︎︎︎︎ Listen on Amazon

The Underwear Oracle, Lipstick Effect and Fro Za Indicator + more weird but true Recession Trends!

![]()

The last few episodes were all about trend predictions based on insights from personal research and experience as well as a whole episode on Pinterest and their predictions based on trending data point.

Well this episode we will take step a little outside of these predictions to narrow in on consumer trends that indicate economic positions in the market landscape and in particular soft economic landscapes and even, dare we say, how recessions effect customer behavior with some weird - but true! - trends!

New York Times:

We touched on this in our last episode but the threat of a recession has been looming - and whether we fall into a full-fledged recession in 2023 or not - the threat of financial uncertainty is certainly in the air and creates its own trends!

So many industries have their own signifiers - trends in their own niche that tend to happen during or around the time of a recession. I took a look at a few of these and am very excited to share them with you all!

The Lipstick Effect:

is a classic and likely one you have heard of since it is very popular in the fashion in beauty world.

- Juliet Schor first coined the term in her 1998 book The Overspent American which is a treatise on overconsumption in America that plagues people who continuously find little satisfaction from incessant spending and chasing more and more goods by working tireless hours. So, you know, capitalism.

- Schor (who is really legit and also a senior lecturer and Director of Studies, Women's Studies, at Harvard University, writes and lectures widely on issues of work and consumption) found that when money was tight or uncertain - women would increase their consumption of luxury or prestige brand lipstick that they could wear and apply in public and cut back on other luxe beauty products that are used in the privacy of your home - like facial cleansers and eye makeup.

- She writes: “They are looking for affordable luxury, the thrill of buying in an expensive department store, indulging in a fantasy of beauty and sexiness, buying ‘hope in a bottle.’ Cosmetics are an escape from an otherwise drab everyday existence.”

- The trend stayed consistent post 9-11 as well as during the Great Recession in 2008 - with lipstick sales seeing a boost according to Este Lauder.

- What’s more, Sephora reported close to a 35% increase in US online sales in 2020 — stats that likely received a boost from those of us working remotely who needed to be camera-ready for all those video calls during the lockdown.

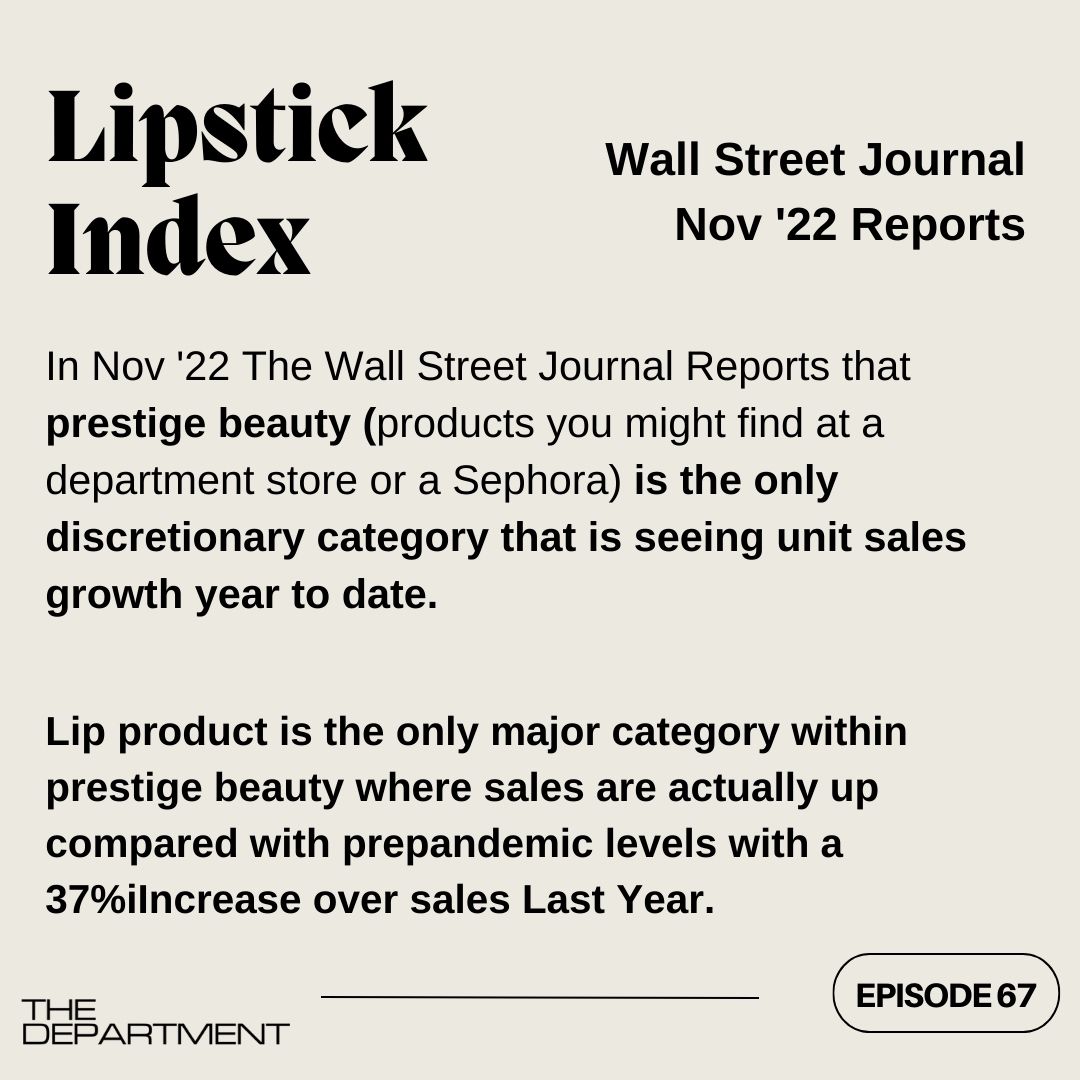

- If this is indeed the category’s leading economic indicator well then it truly paints a picture in 2022 sales: Forbes reports that new data from global market tracking firm NPD Group finds sales of lipstick and other lip makeup grew 48% in the first-quarter over the previous year, more than twice as fast as other products in the beauty category and revenue rising 28% in the second quarter.

- The concept is that in times of a recession and other economic stresses, women will indulge in discretionary purchases that provide an emotional uplift without breaking the budget. Lipstick fits the bill.

- And lipstick sales keep on growing week-by-week with prestige brands taking a bigger share of sales than the mass-market brands. Women are also picking up brighter, more dramatic colors this year, rather than muted, natural looks.

- CNBC had a slightly different hot take on this beauty indicator - recognizing that Nail Polish sales soared during the great recession as people skipped the salon and instead did their nails at home to cut costs and was obvious at both prestige brands and also mass-market brands.

- I would even go so far to say that other little luxuries could include candles and other home fragrances, soap and bath bombs and other things that give you that boost of luxury while not breaking the bank.

The Hemline Index

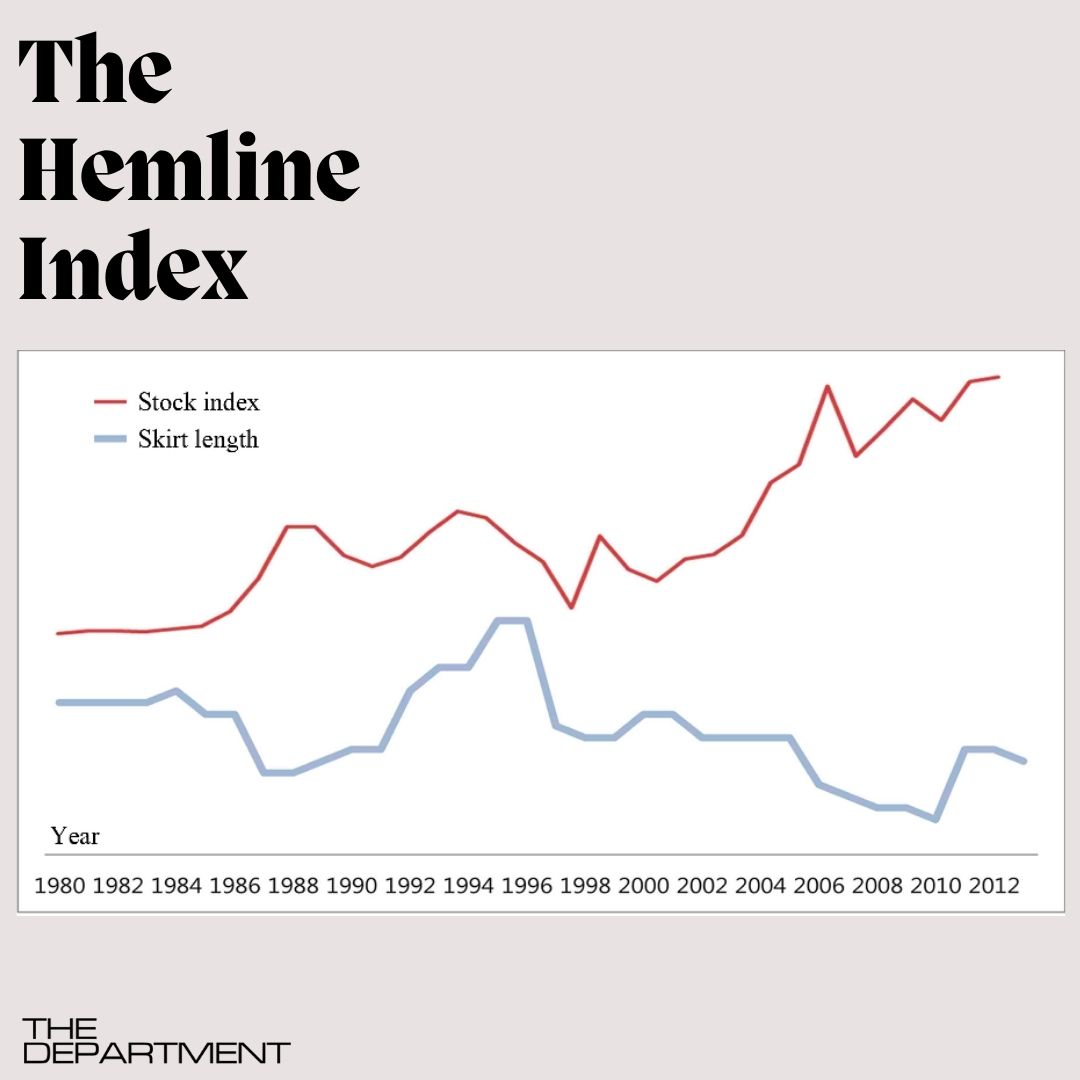

The next indicator that some economists have recognized goes back a bit further than the 90s. The Hemline index is this theory that the lengths of skirts and dresses rise or fall in line with stocks. So during economic hardships, recessions and depressions skirts have historically gotten longer - while in times of a more flourishing economic status we have seen those skirts get shorter.

- This theory which was originally first recognized by economist George Taylor in 1926 - has quite a few examples throughout the years that suggest that the hemline index has been rather a trustworthy indicator and even can help predict future fashion trends.

- I mean - this one isn’t ironclad (well none of them are but they are interesting to look at). I think that as we get more diverse in our style through the years and as style becomes not just more democratic and affordable but also just moves so quickly - this will be a bit more challenging to prove in the 21st century - but you can see it pretty opaquely in the 20th century as silhouettes often tended to follow mono-styles based on more universal trends.

- So some of the most notorious illustrations of this indicator really started in the 1920s when the hemlines become more cropped and playful with the flapper look as post WW1 brought the roaring 20’s which came to a halt in 1929 with the Wall Street Crash and we moved into the great depression skirts also became more conservative and dropped with longer lengths. When the west saw some relief in the 1930s as we grew out of the depression skirt lengths started to show some shortening again only to fall back to the knee with the start of World War II. The US recession of 1949 was preemptively ushered in by a longer skirt of the Dior New Look. As we made our way into the 1960s and the economy was slowly righting itself - we saw the hemlines get shorter and even saw the introduction of the mini skirt. Shorter styles stayed at the height of fresh youthlike style until the double dip recession of the early 1980s which led to power suits with below-knee skirts. There are many smaller examples too, but you get the idea.

- A duo of dutch researchers put this theory to the test in their research paper called “The hemline and the economy: is there any match?” In their research of what they call an “Urban Legend” - they found that collecting and correlating monthly data from 1921-2009 that:

- “the main finding is that the urban legend holds true but with a time lag of about three years. Hence, the current economic crisis predicts ankle length skirts around 2011 and 2012“, meaning that they predicted that longer skirts would become more popular in 2011 and 2012 which was a few years after the 2008-2009 recession. Any you know what - they were right - boho maxi skirts and dresses did have a resurgence!

- So using that theory - we can predict that longer skirts could start seeing traction either as an effect of the pandemic led recession from 2020 in 2023 or the current economic downturn of 2022 would be more persistent in 2025.

The Necktie Index

So this is a bit of a two-parter of indicators - on the velocity of sales and the silhouette. One of the first observations on the Necktie Index is that (in general) - the more senior officers of the company wear neckties, and the more meetings they attend, the more trouble the company is in.

- This also trickles down to more than just exclusively c-suite staff member. When there is economic hardship - more men wear ties to build a more robust professional air as they buckle down to work. In theory, tie sales will increase to react to this demand to look more professional and keep your job.

- There is also an indicator that ties get slimmer during bad times and brighter when the economy starts to recover. As the message that your tie gives off in the business world and the correlation to the mood of the economy- so the more daring the color the more economic success and prowess and the more conservatively colored in trend the more depressed the economy and need to exude mature and formal sartorial statements.

- Charlie Allen, a tailor based in North London, said: "The impact of economic turmoil on tie design can be traced back through the previous recessions of the 20th century. While post-war Britain and the swinging sixties embraced exaggerated prints and widths of up to 5 inches, the downturns of the 1930s and 1980s saw sizes reduce to as little as an inch."

- So if anyone lives by a financial district please send us some snaps or share your insights - I am very curious what the bros are wearing these days!

The Underwear Effect

So the underwear effect is just how it sounds - men’s underwear sales decline during economic downturns. In fact, during the 2008 Great Recession, the head of the Financial Reserve Alan Greenspan actually told reporters about this and followed the trend of men’s underwear sales closely noting that men tend to buy fewer new undies when the economy is rocky because it’s the last item of clothing men will replace, even if it begins to form holes.

- Alan Greenspan once told NPR correspondent Robert Krulwich “the garment that is most private is male underpants because nobody sees it except people in the locker room, and who cares? [Sales are usually stable] so on those few occasions where it dips, that means that men are so pinched that they are deciding not to replace underpants.”

- I don’t have the data for 2022 but you can see the story loud and clear - during 2008 and then really effect 2009 as well as the apparent drop in 2020….I will be curious how 2023 pans out!

The Sports Illustrated Swimsuit Issue Indicator

Amanda, I don’t know how much - pardon the pun - stock I put in this one and it feels a bit like chasing the groundhog here - but one of the most unconventional economic indicators revolves around the Sports Illustrated Swimsuit Issue Cover model! The theory suggests that the US stock market has a booming year when the cover model is American and underperforms in the years when the cover model is non-American. I am not making this stuff up.

The Fro Za Index:

The Grocery store also has its own indicators - you can likely imagine as well that Frozen Pizza can act as a financial score card - same can be said for canned beans and boxed mac & cheese as consumers cut costs by replacing delivery with frozen pizza and mac & cheese and reduce costly cuts of meat with canned beans.

- Not shockingly in 2009 In 2009, Kraft (KHC) posted increased sales as consumers turned to DiGiorno and boxed macaroni.

- During 2009, the value of baked beans soared 23% in the U.K. as consumers fell back on the staple instead of going out for dinner.

- I think this is going to be more popular than ever - invest Nestle and Kraft stocks in 2023 cuz if this trend of economic slowdown continues everyone is going to be eating a lot of frozen pizza and mac & cheese. Especially with the added costs of delivery these days - it is an actual luxury to order a pizza.

Champagne Indicator

Lastly - and no I didn’t cover them all - there are like a bunch more that narrate how consumer spending is affected by the economy like haircuts, and dry cleaning, movie theater tickets and even skyscrapers- and discretionary expenses that add up…..but one of the most reliable indicators according to economists is Champagne Sales.

- The New York Times even reports with nearly 90% accuracy that the amount of French Champagne that Americans consume has predicted the average American income one year later.

- And with good reason - champagne is the universal signifier of celebration and goods times as well as a luxury splurge product. So it makes sense that consumers pop open bottles when they feel financially confident and swap down to other libations when times are tougher.

- Champagne consumption rose to 23.2 million bottles in 2006, before cratering to just about half of that by 2009, according to Bloomberg. NielsenIQ data indicate that in 2022, sales of sparkling wine have been down every month from the previous year.

And what can we take away from all these indicators? Well if you go to the grocery store and see pizza aisle looking a little slim pickings or grocery carts full of beans and kraft mac and cheese….we might be heading toward a recession.

If you go to work and see more and more ladies painting their lips red while an increasing number of men swapping their polar fleece vests for button-ups and ties and last year’s imported french champagne toast is swapped for some hard seltzers or domestic prosecco….we might be heading into a recession.